Let's say a licensed master plumber has his own one man business where he goes around on his own work truck doing service work at people's homes. He works 30-40 hours a week Monday through Friday and about 90% of the calls he does are repeat customers.

But then, for some reason or another, he loses his business livense.

So he figures:

"No problem, In ten years in business never once has a homeowner asked to see my license. And I don't even advertise, most of my new customers are word of mouth referrals and write ups on community websites singing my praises. Pays to be that good. And the IRS doesn't give a rats patooty about it as long as I pay taxes on it. So yeah, this loss of my business license means nothing. I think I'll keep answering my phone and doing work as usual."

In the hypothetical event that I, I mean, some random plumber, lost their business license, could they get caught? If so what are the consequences if he loses his business license, but they just keep catching him doing service calls as usual?

But then, for some reason or another, he loses his business livense.

So he figures:

"No problem, In ten years in business never once has a homeowner asked to see my license. And I don't even advertise, most of my new customers are word of mouth referrals and write ups on community websites singing my praises. Pays to be that good. And the IRS doesn't give a rats patooty about it as long as I pay taxes on it. So yeah, this loss of my business license means nothing. I think I'll keep answering my phone and doing work as usual."

In the hypothetical event that I, I mean, some random plumber, lost their business license, could they get caught? If so what are the consequences if he loses his business license, but they just keep catching him doing service calls as usual?

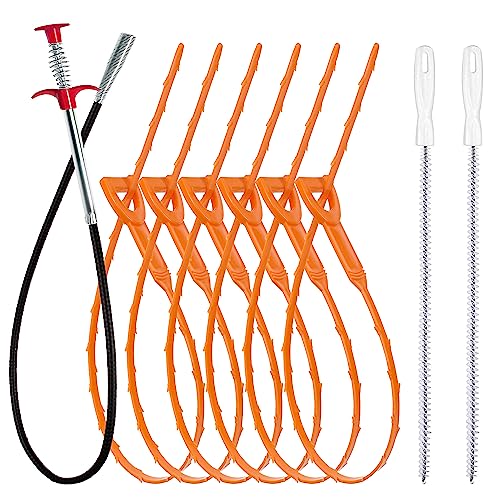

![MEISTERFAKTUR drain snake 2.0 [50 FT] - with drill attachment - Ideal plumbing snake for sink and drain unblocking - Solid drain auger for real DYIs! (50 FT - 1/4 inch)](https://m.media-amazon.com/images/I/41VwmTiOsgL._SL500_.jpg)